Eur-Usd, S&P 500 and Dow Correlation

Eur-Usd, S&P 500 and Dow correlation is strong correlation that every trader must understand. Also understand that S&P 500 and Dow's correlation with Eur-Usd is very dynamic.

Learn more about currency correlation. Click here.

Generally speaking, if the U.S. equity market like S&P 500 and Dow Jones is rising, then foreign investment dollars will flock the U.S. equity market by leaps and bounds pumping the U.S. dollar higher.

If the equity market is falling then the domestic as well as foreign investors will sell their shares to seek investment opportunities abroad thereby dragging the U.S. dollars down.

However this relationship can be very uncanny in times of economic uncertainties.

I specifically trade only EUR/USD. The sole reason being I would rather be master of one trade rather than jack of all trades and master of none.

Currency market is very dynamic. Topnotch traders must always stay tuned with every forex fundamentals to stay ahead in the game.

Personally for me, to make a comfortable trading decision I need to know every fine fundamentals about EUR/USD.

Eur-Usd, S&P 500 and Dow correlation is one such example that I watch like a hawk.

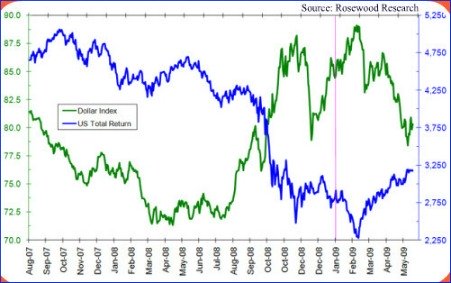

Fig. 1. Dollar Index and U.S. Equity Return Negatively Correlated in 2009

Fig. 1. Dollar Index and U.S. Equity Return Negatively Correlated in 2009

Figure 1. in the graph shows a negative correlation between the U.S. dollar Index and the U.S. Equity total return in 2009.

This strong negative correlation stands at -0.86%, meaning that when the U.S. dollar is up the equity market is down and vice versa.

Number adds more meaning in analysis but the mirror image of dollar with the U.S. equity returns give clear picture about this strong negative correlation.

In another words, currently (as of Nov. 2009), Eur-Usd, S&P 500 and Dow correlation is strongly positive correlation, i.e. Euro up = Dow up = S & P 500 up.

This correlation came to exist around 2003 after the tech bubble burst.

Normally the effect should be when Dow or S & P 500 is up we would expect U.S. dollar to strengthen, however; the current negative correlation -i f Dow and S & P 500 up the U.S.dollar down, could be credited to the fact that investors are not yet convinced of the long term stability of the U.S. economic health.

Should the U.S. economy rebound, investors both domestic and foreign will flood the U.S. equity driving demands for U.S. dollar and other U.S. dollar denominated assets. Then and then only we should see reversal in the current correlation that is in existence among the Dow, S & P 500 and EUR/USD.

Needless to say, a relationship exists between the Dow, S & P 500 and EUR/USD.

It will be wise for every forex trader to keep their third eye and the sixth sense monitor these correlations in search of better trade opportunities.

Have your say about what you just read! Leave me a comment in the box below.