Forex Buffer Building Goal

Buffer building must be in a must...must...must got to do list in every forex trader's to do list in the beginning stage.

No exceptions to it...and I mean it seriously.

You will thank me and thank yourself for doing this big favor.

But the irony is that very few retail forex traders abide by it.

This also sheds light why very few retail forex traders, about 3-5% to be exact, actually succeed and rest other 95% fail sooner or later.

Forex brokers, and other forex preachers most notoriously entice virgin souls into forex trading selling dreams that making money in forex is just as easy as identifying red and green signals, which in fact, is not.

My logic tells me if forex trading was that easy then everyone should be making plenty of easy money.

Why would anyone ever have to remain suffocated in a tiny cubicle 40 hours a week for 40 years?

Having said so, I have also realized if I invest enough time in forex education, then upside potential of earnings from forex trading is unlimited. so, I assume you now realize the importance of buffer building process and forex education.

Think of forex trading as guerrilla warfare where the only rule is -"either kill or be killed".

Would you not want the best armor and the best weapon?

Let's walk through the buffer building phase.

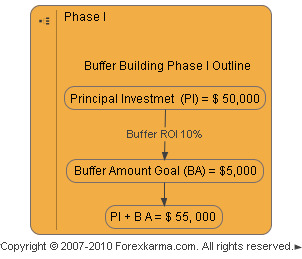

Forex Buffer Building - Phase I

Phase I Outline

Phase I Outline

Principal Investment (PI) = $50,000

Risk ONLY 0.5% to 1% of Principal Amount per account per trade during buffer building phase.

So, $50,000 x 1% = $500

Consider a Standard or Regular Trading Account (=100K per lot) that pays $10 per PIP.

If I can risk $500 per account per trade means I can not risk more than 50 PIPs per trade on my regular account (= 50 PIPs x $10 = $500).

At any event, I will not risk more than 50 PIPs or 1% of my initial investment, whichever is lesser during this phase.

In the most extreme adverse scenario, I will have to make 100 consecutive losing trades to completely lose all my initial principal investment of $50,000 at the rate of $500 or 50 PIPs per trade.

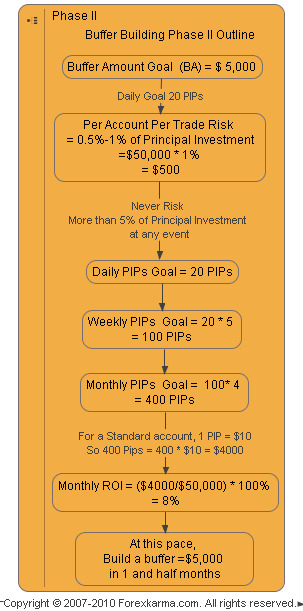

Forex Buffer Building - Phase II

Phase II Outline

Phase II Outline

My daily goal is to gain 20 PIPs per DAY.

With $500 to risk, I can break it down to number of mini lots (=10K per lot) or just simply trade 1 standard or regular lot (=100K per lot).

For simplicity, I will stick with 1 standard or regular lot per trade that pays $10 per PIP.

So, 20 PIPs x $10

= $200

At the rate of 20 PIPs per day, my weekly PIPs goal

= 20 x 5

= 100 PIPs per week.

My weekly goal

= (20 x 5) PIPs x $10

= $1000 per week.

At this rate my monthly PIPs goal

= 20 x 5 x 4

= 100 x 4

= 400 PIPs per month.

This converts to monthly gain of

= 400 x $10

= $4000 gain per month.

So my monthly RoI

= ($4,000/$50,000) x 100%

= 8%

My buffer goal is minimum of 10% of my Principal investment.

So, buffer amount goal

= $50,000 x 10%

= $5,000

At the above rate, I'll reach my minimum buffer amount goal in 5 weeks period.

After 5 weeks period, I strictly play ONLY the profit, i.e. risk only the buffer amount beyond this point.

I do not expose my principal investment unless I am absolutely certain, 1000%!!! to be exact.

Or to the point the sky will be falling down on Monday morning at 8:00 A.M. EST and the U.S. dollar is going to jump to the roof for whatever consequences it might bring...you basically got the idea, didn't you?

I think of buffer building process as my best armour and investment in forex education as my best weapon.

What's your take on buffer builiding?

-

Return to

- Buffer Building

- Money Management

- Home

Have your say about what you just read! Leave me a comment in the box below.