Entry Size Essential

Understanding entry size is the first step in making good trading decisions. It's absolutely a must in order to avoid margin call.

My forex brokers determine a margin call based on usable margin and not on account balance or equity. Thus I make my entry decision based on my usable margin.

Learn more about margin basics.

Let's put my entry size strategy to practice on EUR/USD pair.

I have chosen leverage of 1:200. So technically I will need to maintain a usable margin of 0.5% or higher at all time after I open my trades.

However my broker requires me to add a small cushion as a safety-net besides 0.5% margin requirement.

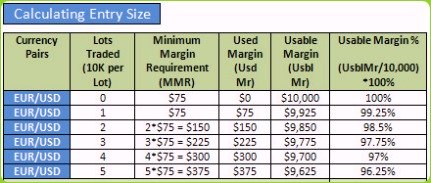

Next, let's determine margin and entry size for a mini account, i.e. 10K per lot that pays $1 per pip.

Say I have a usable margin of $10,000 to begin with. I want to make ONLY 1-2% entry based on my usable margin of $10,000.

So,

= $10,000 x 2%

= $200

Hence, if I make a 2% entry trade, my usable margin will be reduced to

= $10,000-$200

= $9,800

But how do I determine how many mini lots should I trade to stay within my 2% entry range?

Let's do some math here...

For 1 mini lot (=10K per lot) at 1:200 leverage, technically I need only 0.5% as a margin per trade.

Mathematically,

Margin = (Current Price x Trade Size x Margin Requirement) x 100%

In this case, say EUR/USD is trading at 1.3160

Margin = (1.3160 x 10,000 x 0.5%)

= $65.8

However, my broker adds a small cushion besides $65.8 in margin requirement.

So I need $75 as a margin on 1 mini lot trade.

This means I can trade 2 mini lots and use 2 x $75 = $150 as a margin.

If I am really comfortable then I may as well trade 3 mini lots instead and use 3 x $75 = $225 as a margin.

Calculating Entry Size Chart

Calculating Entry Size Chart

Similarly, I can trade 4 mini lots and use up to 3% of my usable margin as seen in the above chart.

Mathematically,

= $10,000 x 3%

= $300

So 4 mini lots require margin of 4 x $75

= $300 Used Margin

My Usable Margin

= $10,000- Used Margin

= $10,000 - $300

= $9,700

My Usable Margin Percentage

= (Used Margin/$10,000) x 100%

= ($9,700/$10,000) x 100%

= 97%

:=)

If you refer to the forex entry size chart above, then you will notice that my usable margin percentage is above 90%. And this is the goal behind understanding calculating entry size strategy.

I always...always stay above 90% usable margin percentage to avoid margin call.

...OK...I confess sometimes I bend this rule a bit but understand how important it is.

No forex brokers will ever teach any trader on these basics; however, they will slap traders with thousands of indicators instead.

What good is any indicator if a trader simply does not understand these basic money management rule?

The bottom line is if a trader has a sound understanding of money management and follows strict forex entry rule of 2-5% of usable margin at all the time, the trader will more likely avoid margin calls.

So how do you determine your entry size?

-

Return to

- Entry Size

- Money Management

- Home

Have your say about what you just read! Leave me a comment in the box below.