Equity Building Plan

Equity building should not be confused with buffer building.

I am assuming you have gone through your buffer building process by now.

The goal of buffer building process is to protect our initial principal investment. But the goal of equity building is to grow our account size over a period of time.

Here, I will discount any ideas or thoughts or dreams of turning $1000 to $10,000 in a matter of week or month as preached by any knuckleheads. Instead, I will work on a very realistic long term approach just like the investment bankers.

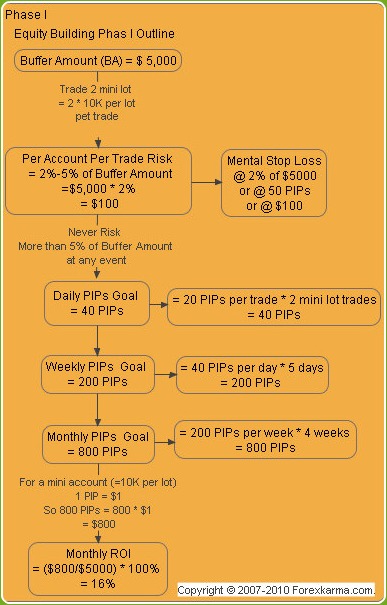

I will begin with the buffer amount (BA) of $5000 and will not expose my initial principal investment (or seed money) at any circumstances.

Buffer Amount (BA) = $5000

Risk 2% to 5% of $5000 ONLY per trade per account at any time.

= $5000 x 2%

= $100

At this rate, I'll have to make 50 consecutive losing trades to lose all my buffer amount (BA)

= 50 x $100

= $5000

In the event, I lose all my buffer amount then I start with buffer building - Phase I.

Let's move on...

Risk Measures

During buffer building phase I stick with strict 0.5% to 1% risk on my initial investment. However, during equity building phase, I vary my risk per trade per account between 2% to 5% at the most.

Remember this risk I am taking is only on the buffer amount and not on the initial principal investment.

So at $100 or 2% to risk out of $5000, I can trade 2 mini lots (= 2 * 10K per trade) per trade per account at any time.

In a mini lot I get paid $1 per PIP.

I can bear up to $100 or 50 PIPs or 2% of the buffer amount per trade as a loss but no more.

So if I am trading two mini lots per trade then I will cut out my losses by closing any open positions

when my loss reach either $100 or 50 PIPs or 2% of the buffer amount.

50 PIPs x $1 per PIP x 2 mini lot

= $100

Be that as it may, I do not necessarily put my stop loss order 50 PIPs beyond my open position.

Let me clarify further if I may.

My stop loss are predefined and are mental stop loss rather than actual stop loss placed in my broker provided trading platform. I execute my stop loss when it fulls the criteria that I have predefined.

In this scenario, I will execute my mental stop loss by closing any open positions when my loss reaches $100 or 50 PIPs or 2% or my buffer amount.

When I have open trading positions 99% of the time I will be at my trading desk constantly watching for my 20 PIPs if not more.

On rare occasions when I have to be away from my trading desk for some important errands then and only then I will actually place stop loss order in my broker provided trading platform.

You can call placing mental stop loss as my trading "idiosyncrasies" that I have come to establish over the year. Every trader will too develop certain "idiosyncrasies" over the course of their forex journey.

My equity building process is slow but very realistic as opposed to an exuberant income hypes in forex industry.

Workout Plan

My daily, weekly and monthly goal plays out as following...

Trades

2 mini lot trades (= 2 x 10K per trade) at any given time that pays $1 per PIP per 1 mini lot trade.

Daily Goal

My daily PIPs goal is 20 PIPs per trade per DAY.

= 20 PIPs per trade x 2 mini lot trades

= 40 PIPs

Equity Building Outline

Equity Building Outline

Weekly Goal

At the rate of 40 PIPs per day, my weekly PIPs goal is 200 PIPs.

= 40 PIPs per day x 5 days

= 200 PIPs

Monthly Goal

At the rate of 200 PIPs per week, my monthly PIPs goal is 800 PIPs.

= 200 PIPs per week x 4 weeks

= 800 PIPs

This 800 PIPs gain converts to monthly gain of $800.00

= 800 PIPs x $1 per PIP

= $800.00

So at the end of my equity building month say end of January 2010, my equity will be $5800.00

= $5000 + $800

= $5800.00

This reflects the monthly ROI of 16% based on the buffer amount and not the principal investment.

=($800/$5000) x 100%

= 16%

= ...Not bad...and very realistic goal!!!

:=)

Continue with this procedure of equity building process to grow your account size day by day, week by week and month by month.

My equity building goal is to grow account size over a period of time as opposed to the view of many mainstream forex retail traders. This process is slow but very realistic as opposed to an exuberant income hypes in forex industry.

So what forex equity building strategy have you employed?

-

Return to

- Equity Building

- Money Management

- Home

Have your say about what you just read! Leave me a comment in the box below.