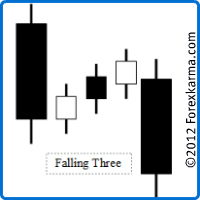

Falling Three Candlestick Pattern

The Falling Three candlestick pattern is a powerful bearish candlestick continuation pattern.

It consists of five candles. It occurs in an downtrend siginfying that the market is in a brief consolidation period followed by it's downtrend move.

The Falling Three Candlestick Pattern

The Falling Three Candlestick Pattern

For the candlestick continuation pattern to be confirmed as the Falling Three Candlestick Pattern following criteria must be fulfilled:

- This continuation pattern must occur in a downtrend.

- This continuation pattern must consists of five candles.

- The first day candle must be a full black (bearish) bodied candle. It must close lower than the previous low to confirm the existing downtrend.

- Over the next three trading period three small bodied reaction candles trend upward. These three smaller bodied candles form counter trend to an existing downtrend.

- All the three small bodied candles must remain within the range of the first day's full bodied black (bearish) candle.

- At least two of these three small bodied candle must have white (bullish) bodies, i.e. the close price must be higher than the open price.

- The fifth day candle must be a full bodied black (bearish) candle. It must close at a new low as compared to the first day full black bodied candle.

The opposite is true for the case of the rising three candlestick pattern.

The text book perfect Falling Three is formed infrequently. However in reality some flexibility could be applied.

Sine the candlestick analysis is a subjective notion, the details on the formation of candlestick continuation pattern as explained above might change from one trader to another from their viewpoint of experience and knowledge base.

For example, the candles that trend upward to form a counter trend to an existing trend may contain more than just three candles. The requirement is that the counter trend must remain wihtin the range of the first day full bodied bearish candle.

Have your say about what you just read! Leave me a comment in the box below.