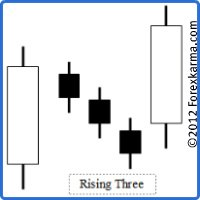

Rising Three Candlestick Pattern

The Rising Three candlestick pattern is a powerful bullish candlestick continuation pattern.

It consists of five candles. It occurs in an uptrend siginfying that the market is in a brief consolidation period followed by it's uptrend move.

The Rising Three Candlestick Pattern

The Rising Three Candlestick Pattern

For the candlestick continuation pattern to be confirmed as the Rising Three Candlestick Pattern following criteria must be fulfilled:

- This continuation pattern must occur in an uptrend.

- This continuation pattern must consists of five candles.

- The first day candle must be a full white (bullish) bodied candle. It must close higher than the previous high to confirm the existing uptrend.

- Over the next three trading period three small bodied reaction candles trend downward. These three smaller bodied candles form counter trend to an existing uptrend.

- All the three small bodied candles must remain within the range of the first day's full bodied white (bullish) candle.

- At least two of these three small bodied candle must have black (bearish) bodies, i.e. the close price must be lower than the open price.

- The fifth day candle must be a full bodied white (bullish) candle. It must close at a new high as compared to the first day full white bodied candle.

The opposite is true for the case of the falling three candlestick pattern.

The text book perfect Rising Three is formed infrequently. However in reality some flexibility could be applied.

Sine the candlestick analysis is a subjective notion, the details on the formation of candlestick continuation pattern as explained above might change from one trader to another from their viewpoint of experience and knowledge base.

For example, the candles that trend downward to form a counter trend to an existing trend may contain more than just three candles. The requirement is that the counter trend must remain wihtin the range of the first day full bodied bullish candle.

Have your say about what you just read! Leave me a comment in the box below.