Support and Resistance - What Everybody Ought To Know

Support and resistance is one of the most frequently applied terms in technical analysis.

When I think of support and resistance in financial market, I think of support as the level where the market gets boosted and the resistance as the level or area where the market gets busted.

Support also known as troughs or dip or reaction lows is the level where buying pressure is greater than the selling pressure. So at this level, the bulls are in control and thus take the price to a higher level.

Resistance also known as peaks or rally or reaction highs is the level where selling pressure is greater than the buying pressure. So at this level, the bears now gain control and thus drag the price to a lower level.

DEFINITION OF TREND

Having learned support and resistance, now we refine our vocabulary and explain trend in terms of these new wordpower.

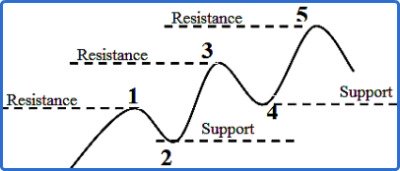

An uptrend consists of higher highs and higher lows.

In another words, for an uptrend to continue, each successive rally high (resitance level) must be higher than the previous rally high and each successive rally low (support level) must also be higher than the previous previous rally low.

In this figure higher highs and higher lows signal an uptrend.

In this figure higher highs and higher lows signal an uptrend.

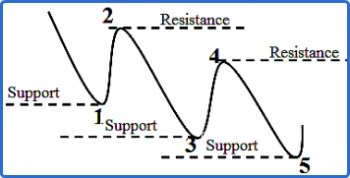

A downtrend consists of lower lows and lower highs.

In another words, for a downtrend to continue, each successive rally low (support level) must be lower than the previous rally low and each successive rally high (resistance level) must also be lower than the previous rally high.

In this figure lower lows and lower highs signal a downtrend.

In this figure lower lows and lower highs signal a downtrend.

Every time market tests support and resistance level, the trend is in crucial phase.

In an uptrend when market tests the resistance level, it must penetrate and exceed beyond the previous resistance level in order to maintain the uptrend.

In the case of downtrend, when market tests the support level, it must penetrate beyond the previous support level in order to maintain the downtrend. Failure to do so potentially gives rise to trend reversal and also the role reversal of support level and resistance level.

SUPPORT AND RESISTANCE ROLE REVERSAL

In an uptrend when market tests the resistance level if it can not penetrate and exceed beyond the resistance level a trend reversal, potentially a downtrend, is in progress.

Similarly, in a downtrend when market tests the support level if it can not penetrate and exceed beyond the support level a trend reversal, potentially an uptrend, is in progress.

As this trend reversal progressess, the support level and the resistance level switch their role.

I think of the trend reversal scenario in conjunction with a mountaineer climbing the Mt. Everest. As the mountaineer approaches the summit she/he is also reversing the role from ascent to descent unless one decides to settle down at peak of the Mt. Everest.

PSYCHOLOGY BEHIND SUPPORT AND REISITANCE AND THEIR ROLE REVERSALS

Trading is a psychological warfare among traders of all size and from all over the planet. In our attempt to understand psychology behind why and how support and ressistance works so beautifully in trading we will attempt to decode psychology of traders in any market.

The traders in any market can be categorized as: the longs, the shorts, and the neutral.

Traders who have bought positions are said to be longs. Shorts are traders with sold positions. And traders who are uncommitted to any positions are said to be neutral.

For the illustration matter, consider a forex market hoovering some where at around support area. Now assume the market gather steams out of good news and thus starts to move higher from the support area.

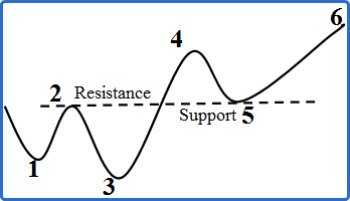

In this figure, wave 2-3-4-5 shows how as the downtrend reverses, resistance becomes support.

In this figure, wave 2-3-4-5 shows how as the downtrend reverses, resistance becomes support.

Now the real mystery of trading begins to unfold gradually.

The longs, traders with buy positions, are glad that the market price is moving higher in their favor.

The shorts, traders with sell positions, begin to panick as they realize that they are on the wrong side of the market. They are at this moment praying that the market would dip to their break even point so they could get out of the market and set their foot on the right side of the market.

The higher market price should send wake up call to the neutral party. Then they desire to enter the market on the long side on the next favorable buying opportunity.

Hence all the traders have vested interest in that support area. Should the market price decline close to that support level, all the three group of traders will act on their vested interest by initiating long positions which in fact pushes prices higher.

However, if the prices start to move beyond the support level, the reaction just becomes opposite.

Traders with long positions are the one now praying as the price advances against their favor. They are hoping they could get out of the market at break even point. And they desire to cover any losses by initiaing short position on the next favorable selling opportunity.

The shorts are partying as the prices decline lower and lower in their favor.

The lower price once again wakes up the neutral party to jump on the bandwagon on the sell side.

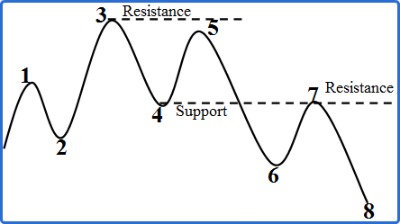

In this figure, wave 4-5-6-7 shows how as the uptrend revereses support becomes resistane.

In this figure, wave 4-5-6-7 shows how as the uptrend revereses support becomes resistane.

And in a very sleek manner, now the market has gone through remarkable metamorphosis. Support has become resistance.

Now all the traders have their vested interest shift to the resistance level. Any price bounces or rallies will hit the hard ceiling formed right at around this resistance level.

SIGNIFICANCE OF SUPPORT AND RESISTANCE

The significance of any support and resistance level is established based on three factors:

- the length of time spent,

- volume of trading and

- how recently the trading took place.

If the market price spends longer time near a support or resistance level, that level of support or resistance become more significant.

For example, if price trades sideways for four consecutive weeks near support level before advancing to next higher level, that support area is considered more significant than if only four consecutive days of trading had taken place.

Volume is another leading factor in determining the significance of support and resistance level.

When support and resistance levels are formed on heavy volume, it indicates large interest of traders near that support and resistance levels. Hence it makes that support and resistance level important.

The last but not the least way to identify the significance of the resistance and support level is by identifying how recently the trading took place. The support and resistance are ultimately the by-product of market participants' reaction to the price movement. So the more recent the activity, the more influential it becomes.

In other words, the reaction of the market participants' is more eye-catcing near fresher support and resistance level.

ROLE OF ROUND NUMBERS AS SUPPORT AND RESISTANCE

A round number is informally considered to be an integer that ends with one or more zeroes (0), such as 10, 100, 1000, 15000....etc.

Market price tends to stall advances or declines around round numbers. Therefore these round numbers act as a psychological support or resistance level.

As a rule of thumb, as the market price approaches round numbers it is wise to take following actions:

- begin profit taking and

- avoid placing trading orders.

-

Return to

- Support And Resistance

- Technical Analysis

- Home

Have your say about what you just read! Leave me a comment in the box below.